ROAS Calculation: The Ultimate Guide to Return On Ad Spend

If you’re considering using online advertising to help you drive new leads and sales for your business, it’s critical that you know how to calculate your return on your investment for ads.

Not understanding ROAS calculation can very quickly cripple an otherwise successful ad campaign.

Our ROAS Calculator is available right here if you’d like to just skip straight to the tool.

Otherwise, stick around for some insight on ROAS calculation and how using them will make your ad campaigns better.

What You’ll Learn in this ROAS Calculation Guide

In this article, I’m going to walk you through the following:

- What is the definition of ROAS

- What ROAS calculations mean for your advertising campaign

- How to calculate ROAS

- Why these calculations matter

- How they will help your ad campaigns start and stay successful

NOTE: we won’t explain how to set up or manage ads in Google Ads, Facebook, or any other platform. Instead, this article will focus solely on how to plan the numbers side of things before you even start to set up your ads.

So, let’s get started…

What Is ROAS?

The simple ROAS definition is “return on advertising spend.” Essentially, ROAS is a form of ROI or return on investment.

Let’s run through a quick example for clarity.

Say you have a product or service to sell, and you spend $1,000 on advertising to promote that service. If that advertising brings you $5,000 in new sales, that would be a ROAS of 500%.

Now, that is an overly simplified version.

In the real world, we have to consider things like cost per click, landing page conversion, price of the product or service, your sales team performance, profit margins, and much more. But it helps get to the root of what we mean by ROAS.

Why Is ROAS Calculation Important?

So, why is calculating ROAS important for your advertising efforts? Well, you’re in business to make a healthy profit, right?

And if you’re investing your money into scaling your business, ROAS is a critical key performance indicator (KPI) you need to know.

The obvious thing here is that you don’t want to spend money on anything in business without getting a return.

Far too often, a new client comes to us with no plan in place, no method of tracking their content marketing or paid campaign performance, and they’re wondering why they aren’t making money.

Basically, it boils down to this: Failing to plan is planning to fail!

Whether your business utilizes one marketing channel (like AdWords) or multiple, it’s important that you plan properly on the front end.

With a solid plan in place, you can better predict, measure, and improve your return.

ROAS vs. ROI

Many people mix up and interchange the phrases ROI and ROAS, and for good reason… they essentially mean the same thing.

The only real difference between ROAS and ROI is that ROAS is specific to advertising, while ROI is a more general term used in all forms of business.

So, if you’re talking about planning your next Facebook marketing campaign, use ROAS to calculate its success.

But if you’re talking about buying that new building or piece of equipment for your business, then return on investment is the correct phrase and measurement to use.

Other than that, they both really mean how much money you are spending on something for your business and what the return on that investment will be.

How to Calculate ROAS

So, now that we know what ROAS is and why it’s important, let’s get right into how to calculate return on ad spend or ROAS!

ROAS Formula

The simple ROAS calculation formula is:

Total Revenue / Total Advertising Cost = ROAS (convert number to a percentage by multiplying by 100)

Here’s a simple example:

Let’s say you spend $2,000 on an advertising campaign and make $8,000 in return. You’d take 8,000/2000, and you’d get four.

Take four and convert to a percentage and you get 400%, which is your return on the advertising spend.

A better, more complex ROAS formula:

For a more accurate measurement, you’ll need a more complex formula. In order to accurately predict and measure ROAS, you’ll need to find some measurements in the middle. Here’s what I mean by that…

- Ad Spend * cost per click (CPC) = number of clicks

- Number of clicks * landing page conversion rate = number of leads

- (Ad spend + other costs) / number of leads = cost per lead

- Number of leads * average sales closing rate = number of closed deals

- Number of closed deals * average sale price = total revenue

- Total revenue – ad spend – other costs = ROAS in %content%lt;/li>

- Total revenue / (total ad cost + other costs) = ROAS in %

Now let’s plug in some numbers for a better ROAS formula example:

- $2,000 ad spend * $5 CPC = 400 clicks

- 400 clicks * 10% landing conversion rate = 40 leads

- ($2,000 ad spend + $500 management fees)/40 leads = $62.50 cost per lead

- 40 leads * 10% sales team close rate = 4 closed deals

- 4 closed deals * $5,000 avg sales price = $20,000 total revenue

- $20,000 revenue – $2,000 ad spend – $500 management = $17,500

- $20,000 / ($2,000 ad spend – $500 management) = 700% ROAS

So, with this formula and a few simple variables, you can very easily predict what your campaign should be BEFORE you ever start. More on that in a minute…

NOTE: some calculations require the decimal place to move for the correct value.

ROAS Calculator

For a long time, I regularly performed these ROAS calculations. After a while, I simply got tired of doing them manually.

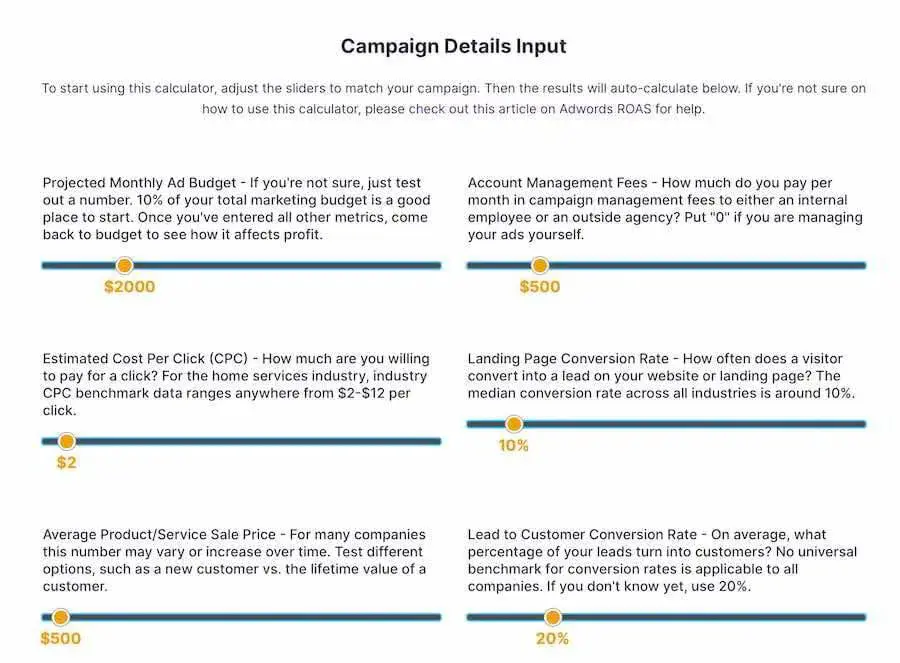

So, I built this handy and easy-to-use ROAS calculator to make both of our lives much easier!

Using this ROAS calculator, you can quickly and easily simulate multiple scenarios of the following:

- Ad budgets

- Management fees

- CPC

- Landing page conversion rate

- Sale price

- Lead to customer rate

Plus, it will auto-calculate all the details we covered above, plus a couple of extra data points!

What Variables Effect ROAS Calculation?

In this section, I’ll briefly outline what those variables I mentioned above are, how they affect total return, and how to accurately measure them.

Technically, there are a number of other factors. However, these are the biggest ones and the biggest KPIs that any good marketer should have.

PRO TIP: If your marketing person or team doesn’t fully understand these performance metrics, it’s time to find an agency that can deliver!

1. Advertising Spend

This portion is the easiest and one of the most obvious variables. Basically, it is the total combined spend on your advertising in a given measured time period.

There’s one important thing to note here, and it may not be as obvious. If everything stays equal, changing this ad budget up or down will not affect the return percentage, but it will affect the total revenue.

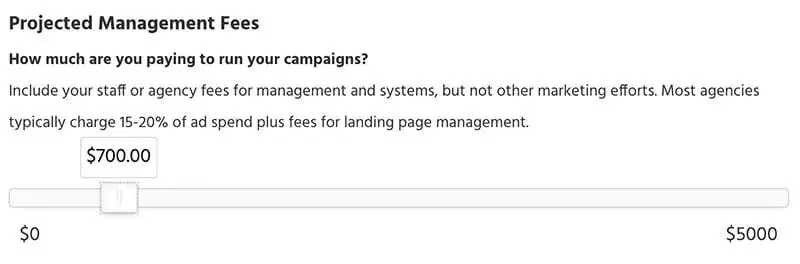

2. Management Fees (“other, other fees”)

Management fees are when you pay an individual (freelancer or employee) or an agency (like us) to manage your advertising.

Typically, this includes the following:

- Ad setup

- Management

- Testing

- Performance improvements

- Landing page management and testing, reporting, and more

If another individual or entity is managing your advertising, you need to have a thorough understanding of where your money is going. That means clarity on specific duties included and their cost.

Otherwise, these ROAS calculations can’t be performed accurately. Some marketers charge a percentage of ad spend while others charge a flat fee, but find out for yourself!

Another key point is that most people and agencies will usually report the return on ad spend without calculating their fees.

This is simply because these numbers can be calculated in advertising platforms without extra work.

NOTE: Inputting your fees in our calculator will do this for you automatically.

3. Cost Per Click (or cost per action)

The cost per click, or cost per action if using optional metrics, is the cost of an intermediate result.

Basically, to get sales online, you have a simple formula:

traffic * conversion = results. So, CPC is the metric that is driving your traffic. And it’s a super important metric to be mindful of.

If you keep everything else the same in this formula, raising or lowering the CPC will raise or lower the end result, respectively.

However, sometimes, using certain methods to get cheaper clicks can result in junk traffic, which can hurt your conversion rate in the long run.

NOTE: This metric can be easily estimated in Google’s keyword planner. Input one or more keywords into the planner, select your location, and hit go, and you’ll see the estimates of bid ranges. Use that data in these calculations.

4. Landing Page Conversion Rate

Conversion rate is basically how many people land on your page vs. how many people complete a conversion event. A conversion event is anything like filling out a form, calling a trackable phone number, or ordering a product online.

So, if 100 people go to a page and 15 people convert, your conversion rate is 15%.

While this article doesn’t have time to discuss the specifics of website landing page design and its psychology, this is one of the most overlooked and underperforming aspects of almost all client accounts we review.

Think about it this way…

If you have a current ROI of, say, 200% with a landing page conversion rate of 5%, and you double that rate, you’ll double your return as well to 400%.

The bottom line is that performing ad campaigns requires both a good ad campaign and a good landing page.

Oh, and sending ad traffic to your home page is also a big no-no. Make sure to use a real landing page!

5. Average Sale Price

The average sale price is nothing more than the total dollars of revenue divided by the total quantity of sales in a given period of time. All accounting programs can give you these numbers to figure this one out.

Here’s an example:

Let’s say you have $25k in revenue in one month and sold to five customers. That means you have an average sale price of $5k.

One important note here is that the average price going up or down only affects the return dollars and percentage. It has no other effect on anything else, at least from the calculation side.

It may be worth testing different pricing models to see what you can close the most, but that’s for another article!

6. Lead to Customer Conversion Rate

The last metric for ROAS calculations is the lead-to-customer rate. This is similar to the landing page conversion rate.

You can calculate your percentage by taking the number of leads your team has and dividing it by the number of customers.

For example:

If you talk to 100 leads and close five deals, then your lead-to-customer rate is 20%.

This number is also a huge number in your ROI. After all, you can get all the highest quality leads in the world, but if your sales skills aren’t up to par, you’ll lose those deals, and you won’t make money.

So, it’s important to have a sales team that can handle and close the deals you generate from your marketing.

What Is a Good ROAS?

Saying an exact number or range of an acceptable ROAS would be irresponsible of me.

The fact is there are far too many variables in any business to make an accurate guess.

Value of a Customer

In some situations, it’s not the average price of a sale that matters but rather the lifetime value of a customer. Let me give you a real-world example…

Most dentists offer new patient specials that include cleaning, X-ray, and exam for a special introductory price. Let’s say, in this example, it’s $100.

Now, if you used the long formula example I used above but changed the average price of the sale to $100, you’d have a -84% return. That’s not very good.

However, in most cases like this, a business would consider the average lifetime value of the customer. And not just the initial value.

Similarly, you could calculate the average yearly value. The point is to find what metric works for you, and if you have repeat clients, ensure you are measuring more than just the first sale!

Consider Your Profit Margins

Anytime you are running these types of calculations, you also need to consider your profit margins.

Our calculator intentionally doesn’t have that. But you will need to know it and ensure your numbers make sense for your business.

For example, if you’re a roofer selling a $10 roof, but it costs you $6k for materials, labor, and sales commissions, you know you have 40% left over. But you still need to profit, so you’d have to determine a good, acceptable cost for marketing your business.

Whatever you do, just ensure your margins are large enough for you to continue to grow and thrive.

If you’re still with me and found my advertising calculator, even if you hate the math,

then measuring the return on ad spend isn’t difficult.

However, tracking it isn’t as straightforward as it should be in most cases. This boils down to separating the major KPIs and the systems that report those.

The major KPIs are:

- Ad spend

- Cost per lead

- The number of leads

- The number of sales

- Revenue from the sales.

And here lies the problem—reporting on ad spend, cost per lead, and quantity of leads typically happens within the ad platform itself.

The quantity of sales and revenue from the sales happens in either your accounting system or a customer relationship management (CRM) program.

Because this is disconnected between two different systems, you’d have to continually get that data and put it into another reporting tool, either manually or through an API.

However, there is a more elegant way!

There are a few systems out there that combine a marketing measurement system that integrates with AdWords with a built-in CRM to provide a true end-to-end reporting system.

This type of system is classified as a marketing automation system. There are a few big players in this space, such as:

- Hubspot

- Infusionsoft

- Pardot

- My favorite (and the one our agency uses), Active Campaign.

I won’t get into all that Active Campaign offers in this article. However, as a brief overview, it provides end-to-end reporting for everything we mentioned above.

It also combines marketing and behavioral-based automation, email marketing, social, blogging, landing pages, a full CRM, and more.

Now that you know how to calculate your returns, it’s time to start creating those ads.

When used correctly, advertising is a fantastic marketing method for generating a steady stream of new leads and customers for your business. But when not, you might as well throw your money in a fire pit!

Do you have any ideas or comments to add about the ROAS calculation? Let us know below!

If you’re looking to grow your business but don’t know where to start… click here to schedule a breakthrough call with us.